THE Ministry of Finance and Treasury have confirmed that the exemption measures (both 50 % import duty exemption and zero sales tax) have reduced the domestic price of fuel by $0.35 per litre, which has directly benefited the end-users.

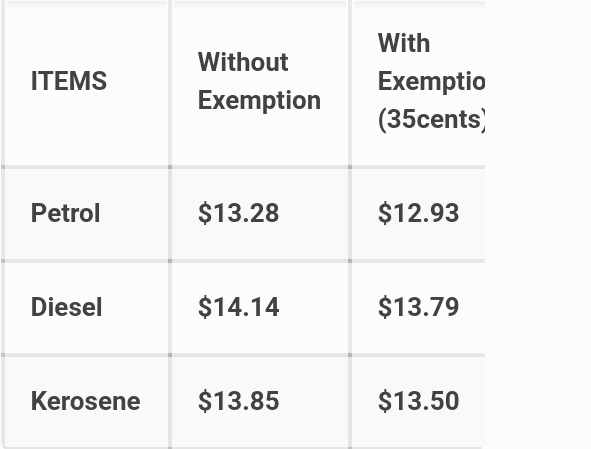

The Ministry revealed that import duty on fuel is normally charged at $0.50 per liter and sales tax is $0.10 per liter. With the 50 % import duty exemption, this means that all domestic fuel price is now reduced by $0.25 per liter and with the zero-rate sales tax, all domestic fuel price should reduce by 0.10 cent per liter. Altogether, the policy provides a $0.35 per liter savings.

The current domestic price comparison on fuel in all pump stations should reflect with $0.35 per litre reduction:

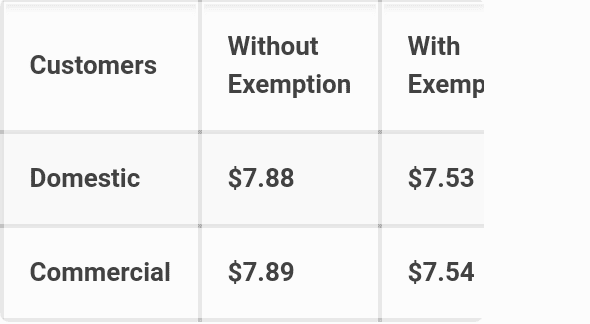

Solomon Power also implements the tax relief measures through its monthly tariff adjustment and customers are expected to see changes when purchasing their bills.

The tax exemptions have minimum influence to the retail price but without the exemption business and individual consumers will experience more price burden under the current domestic price of fuel increase. Even though the government imposes these tax measures, the domestic prices is slightly increase as of 1st June 2022.

This is due to number of factors affecting the price of fuel in the domestic market that are beyond the Government’s control. However, the tax reductions have cushioned the price increases but not reversed them.

The tax measures will be on going for the 6 months and ended on December 2022. The Ministry finally wish to inform public that the international fuel price will continue to increase, but with the relief initiatives, any further increase in the international fuel price within the next 6 months will provide $0.35 per litre savings to all end users.

SOURCE : GCU PRESS.